The digital advertising market reached a new, all-time high in 2023, generating $225 billion in revenue—roughly 7.3 percent higher than 2022, according to the IAB’s latest Internet Advertising Revenue Report.

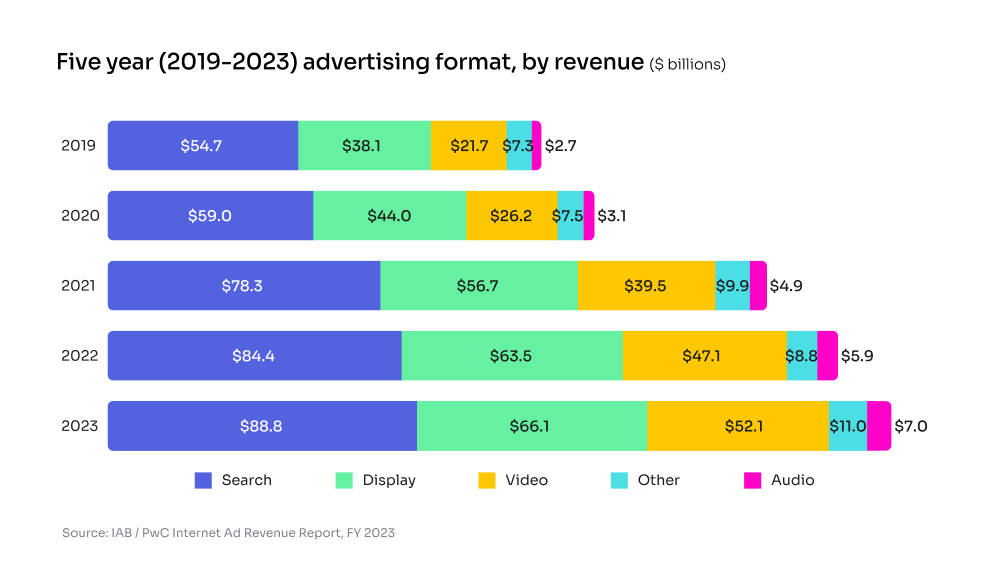

The digital advertising market has nearly doubled its revenue over the past 5 years; in 2019, digital advertising pulled in just $124.6 billion.

Search ads grew by 5.2 percent year-over-year in 2023, pulling in $88.8 billion in revenue. Display ads pulled in $66.1 billion—roughly 4 percent higher than 2022.

Video ads and audio ads pulled in another $59.1 billion in revenue, and both grew by more than 10 percent year-over-year. “Other ads,” a catch-all category that includes digital classifieds, generated $11 billion.

Digital advertising remained heavily consolidated in 2023, with nearly 80 percent of revenue—roughly $179.5 billion—going to the 10 biggest companies in the industry.

How do brands prefer to buy their ads?

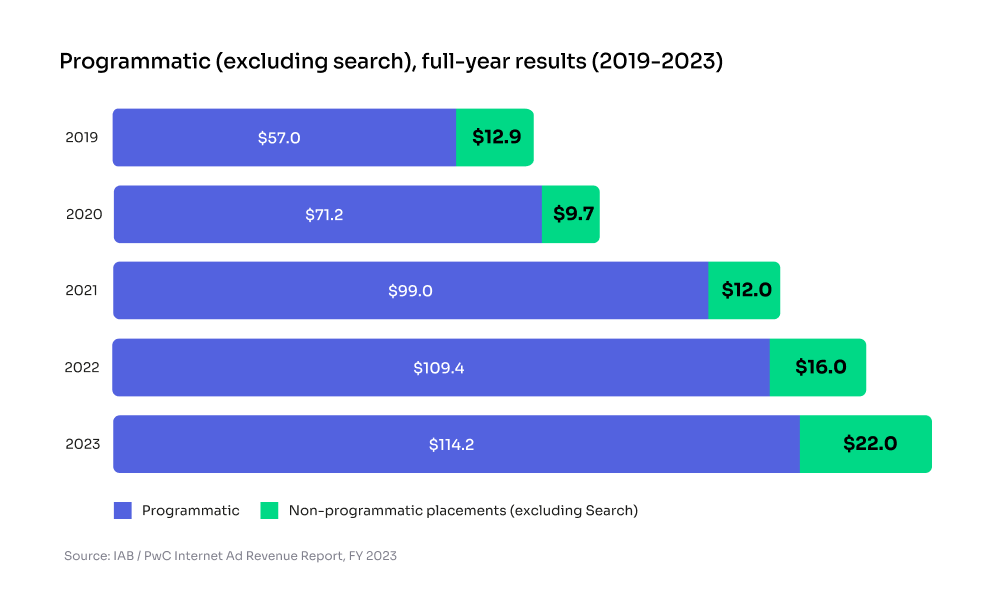

Excluding search ads, brands spent $114.2 billion buying ads through programmatic channels in 2023, and $22 billion buying ads through non-programmatic channels.

Among all programmatic ads, an estimated 63 percent of ads—representing $71.9 billion in revenue—were bought using the Open RTB protocol, while 37 percent of ads—representing the remaining $42.2 billion—were purchased via programmatic direct channels, such as private marketplaces, preferred deals, and programmatic guaranteed deals, according to the IAB.

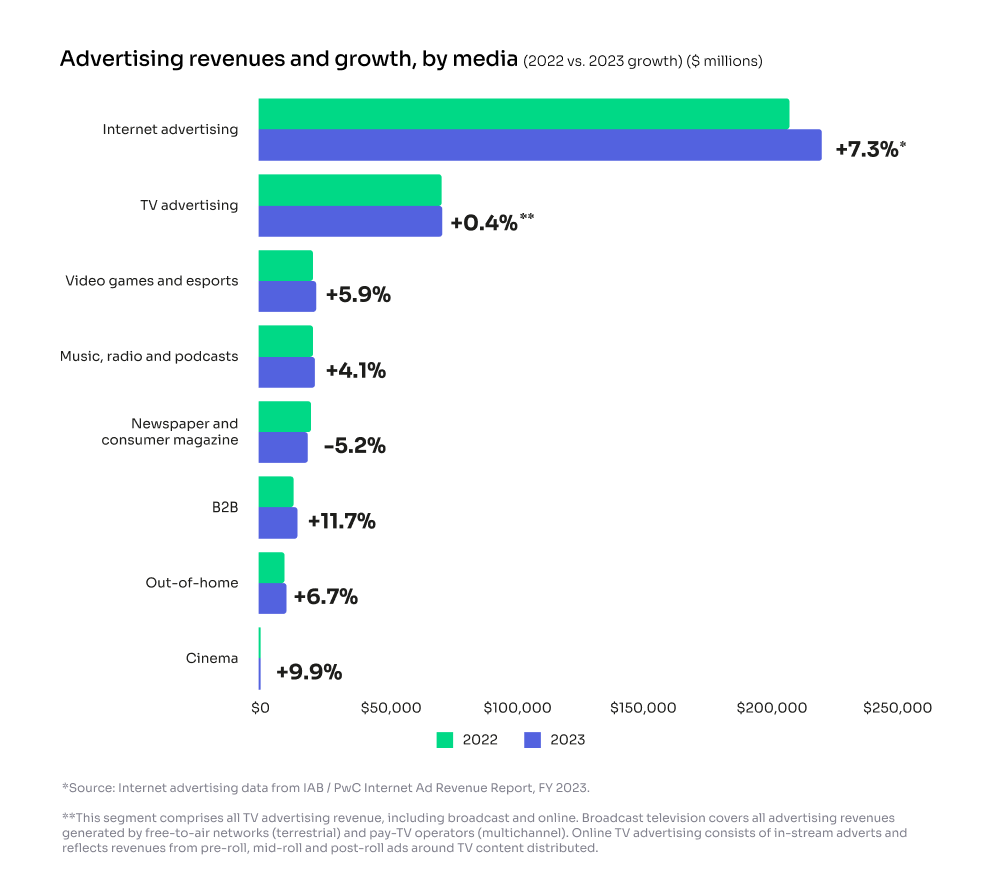

Taking a wider look at all advertising mediums, internet advertising, B2B advertising, and cinema advertising grew the most year-over-year, while traditional TV advertising ended the year flat, and newspaper and magazine advertising declined by 5.2 percent.

Looking ahead, analysts at the IAB identified three major trends to watch for in 2024 and beyond: new privacy restrictions, budgets shifting toward CTV, streaming, and retail media, and the rise of generative AI reshaping how ads are bought, sold, and measured.

On the privacy front, the advertising industry is facing pressure from regulators, who want to restrict the amount of data that adtech companies have access to, and give consumers more control over the data they decide to share. The industry is also being pressured by Apple and Google, which have restricted third-party cookies on their browsers, and mobile advertising IDs on iOS and (soon) Android.

As a result, brands shifted their budgets in 2023 toward the industry’s 10 largest companies, whose ecosystems of first-party consumer data have remained intact. Brands are also investing in first-party data, privacy-compliant data collaboration, contextual advertising, and retail media.

Meanwhile, emerging advertising channels continue to grow. CTV is projected to grow by $17.8 billion between 2023 and 2027, according to analysts at eMarketer. Other red-hot growth areas for advertising include live sports broadcasting moving to streaming services, direct-to-consumer sports apps run by sports leagues, user-generated content from micro-influencers, shoppable ads, and retail media networks, according to the IAB.

Finally, generative AI is reshaping the advertising industry in profound ways. Brands are using generative AI to create data-driven campaign concepts, personalized content creation, and real-time optimization of ad campaigns. Publishers are using generative AI to create content, streamline their commercial processes and cut costs.

Check out the full report here.